- 0share

- 0Facebook

- 0LinkedIn

- 0Pinterest

Do you want to file your individual income tax return? But confused with IRS form 1040 and related schedule. Read our post and get quick summary in 5 min.

What is IRS form 1040?

Form 1040 is for the individual income tax return form. IRS publishes or updates it every year.

How do I get 1040 tax form ?

Ok. So most common question we have. You can get printable 1040 form on IRS website. You can find latest form 1040 here.

Who needs to file form 1040?

Form 1040 is required to file by U.S. citizen who lives or have income or U.S. possession. It covers most of the people including contractor, employees, freelancer or earning income from investment. For self employed, you are required to file the return if you annual income is $400 or more. Even if you have no any income, you might require to file it to get a refund or federal income tax withheld.

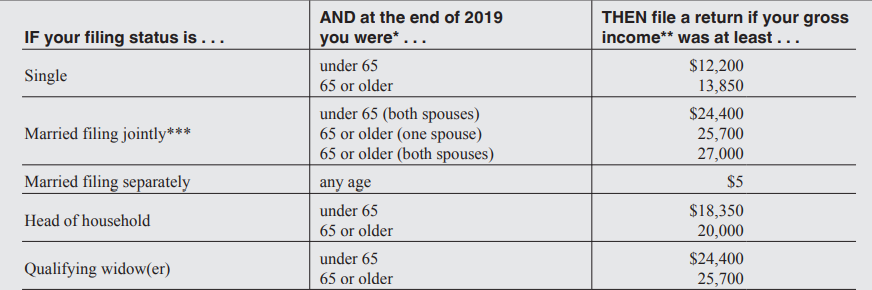

Below chart will be helpful in understanding requirement of US individual income tax return filling.

Image source : IRS Resources

How to file schedule 1040 ?

Form 1040 can be filed electronically or by using manual form. Manual form can be downloaded from IRS site. Here is the link to download the form.

You can e -file the IRS form 1040 by any methods below:

- Using IRS free file facility

- Using tax filling software

- Hiring tax agent

- Yourself

Information required to file IRS form 1040:

If you opt to file yourself, you should have information of following income or deductions.

- Business income

- Dividend or interest income

- Wages

- Gain on sale of assets / capital gain

- Contractor payment

- Medical expense

- Tax paid by you

- Gifts

- Social security benefits

- Federal income tax withheld

- Child benefits

- Rental income

Section wise explanation of schedule 1040:

Basic information:

First section covers all the basic information. It includes the following:

- Your name and spouse name

- Social security number of you and spouse

- Filling status – single, married filling jointly or separately etc.

- Foreign address details

- Dependents details

- Age details

Income details:

In this section, you should show all the income details such as

- Salary details ( Attach form W2 if you have salary income)

- Taxable and non taxable interest

- Taxable and non taxable dividend

- Social security benefits details

- Pension details

- Capital gain – gain while selling capital assets. you may require to attach schedule D

- Other income as per schedule 1

Adjustment and deductions:

Next step is reduce income with adjustment and deductions. You can claim adjustment with form 1 and deductions with schedule A.

After reducing deductions and adjustment from income, you will get amount of taxable income.

Claim credit:

On page 2, you can claim credits to reduce your tax liability further. It includes following credit:

- Child tax credit

- Credit for other dependent

- self employment tax paid during year

- Federal income tax withheld

- Other tax credits and claims

Final tax amount:

You may get final number of your tax liability here. You might have tax payable or you can get tax refund by giving your account info.

Initials :

You should confirm the amount you show in federal tax return by your signature.

Schedule wise explanation of IRS form 1040:

Schedule 1:

This schedule covers income other than shown in form 1040. It covers following income:

- Taxable refunds

- Farm income

- Rental income

- Alimony received

- Rental income

- Unemployment compensation

- Business income or loss

- Other income

You have option to reduce the income with adjustments. Adjustment includes

- Educator expense

- Health saving account deduction

- Self employed plans

- Alimony paid

- Student loan interest

- Tuition fees

- Self employed health insurance deduction

Schedule A:

You need to attach schedule A to form 1040 if you want to claim the deductions. Schedule A covers all the important deductions such as

- Medical and dental expense paid by you

- Taxes paid by you such as local taxes, state taxes etc

- Internet paid by you including home mortgages, mortgage insurance premium.

- Charity above $250

- Theft losses

- Disaster losses

- Other deductions

Schedule B:

You should attach schedule B along with federal tax form 1040 if you have dividend or interest income. However, there is $1500 annual threshold for it. You can simply show your dividend or interest income in form 1040.

Few points you should consider while filling schedule C:

- You should report interest you earned via deposits, bonds or other taxable sources. Keep 1099-IT form with you to confirm the numbers.

- You should report dividend you received from corporations. No matter it is annual or interim. You can get reference of 1099-DIV you received from the corporation while entering the numbers.

- Interest or dividend from foreign accounts and trusts should also be reported. Mention name of the country if required.

Schedule C:

If you are self employed, you need to attach schedule c with form 1040. Schedule C is summary of your business income and expense. It covers all important business finance numbers such as

- Accounting method

- Gross receipts

- Cost of goods sold summary

- Vehicle usage information

- business expense

- Net income or losses

You can read our detailed guide on Schedule C for further info.

Schedule D:

If you sell capital asset during the year, you need to show the details of the transactions with schedule D and form 8949.

Capital gain has two types – Short term and long term. Short term is for the gain where assets held for less than 1 year. If asset is held more than said period, you need to consider capital gain as long term.

You need to show following information on schedule D:

- Sell of assets

- Cost

- Capital gain

- Capital gain from trust, partnership, S corporation

- Carry forward capital gain

- Summary of capital gain which you need to show on federal tax form 1040

You need to attach other forms with schedule D such as form 8949,4684, 6781. Capital gain calculation needs in depth understanding of taxes. Getting help of CPA is vital here.

Schedule E:

If you have real estate income or income from royalty, partnership, S corp, estate, trust, REMICs, You are required to attach form E with tax return form 1040.

Schedule E is divided in 5 parts. You should show following details in the form:

- Rental property – address, type of property, income and expense

- Income or losses ( Passive and non passive) and brought forward losses from partnership and S corp

- Name, EIN, Income or losses from estate and trust

- Name, EIN, Income or losses from REMICs

Form 8949:

Form 8949 help you to show date and asset wise details of capital gain transactions.

It has two parts :

First part shows short term assets’ transactions.

Second part shows long term assets’ transactions.

You need to show following in the table:

- Property description

- Date of purchase of asset

- Date of asset sold

- Sales price

- Cost of asset

- Capital gain amount

What is form 1040SR and what is difference between form 1040 and form 1040SR?

IRS introduced a new designed version of 1040 for senior citizen. ( Aged 65 or more). Form 1040SR is identical to federal tax form 1040 except

- Larger fonts

- Chart listing standard deduction amount

This form can be filled by single or married jointly. You can get the form here.

Where to send form 1040 for individual income tax return?

You can send your form to IRS in paper format in your state. Visit this IRS page for more info.

What is deadline of Form 1040?

You should file your tax return form 1040 by April 15 every year. Except there is any extension in deadline.

Wrap up:

So this was our quick guide on IRS form 1040. Getting help of tax expert to file your return is advisable to avoid mistakes. As soon as you receive income details at the end of the year, gather data and start return filling process to avoid late payment penalty. If you have any further question, ask with comment below. We will add more explanation in our post.

- 0share

- 0Facebook

- 0LinkedIn

- 0Pinterest