- 1share

- 1Facebook

- 0LinkedIn

- 0Pinterest

Do you know the importance of monthly accounting reports such as income statement and balance sheet for small business? It helps business owners to understand true position and growth of business and helps him to take the right decision at right time. There are many accounting reports but in this post, we will go through three most important accounting reports in business. Income statement, balance sheet and cash flow statement

Accounting reports:Income statement and balance sheet

In business, there are 3 primary accounting reports – Cash flow, Income statement and balance sheet

Balance sheet :

Preparation of balance sheet is at the end of the accounting cycle. As a business owner, you need to learn how to read a balance sheet and use it in improvement in your company’s financial position.

Balance sheet is prepared at a specific date. You can ask your accountant to generate balance sheet at year end, quarter end, month end or any date of the year.

Monthly review of balance sheet helps you to understand true position of the business. But it requires accurate and consistent accounting system to get timely reports each month.

Example of Income statement and balance sheet :

Balance sheet can be prepared in two format – vertical and horizontal. Generally, we use vertical format.

Example Format of Balance sheet:

Balance sheet has two major elements. Assets and liability.

Assets:

Assets mean resources owned by a company and which has future economic value.

Assets can have three subcategories:

- current assets,

- non-current assets and

- investment.

Current Asset: Current asset includes asset which can be converted into cash in less than 1 year.

Non Current asset: It includes assets which can be converted into cash in more than 1 year.

Investment: It is the asset having long-term value. It generates profit in long run. Some examples are Fixed deposit, Investment in shares, Mutual fund investment.

Liability :

Liability can be divided in three categories:

- Equity ( Owner’s contribution and reserve)

- Long term liability

- Short term liability

Equity:

This section covers contribution made by owner or owners of business in form of Equity Shares ( Corporate) , membership capital ( LLC) , Partners’ capital ( partnership firm), Proprietor’s capital ( Sole proprietorship).

Calculation of closing capital is done considering fund added and deducted during the year.

If there is any amount held as reserve, it will also form part of capital section.

Long term liability:

As name suggests, this section includes liability due for more than 1 year. It includes following liability:

- Loan from bank or finance institute

- Long term unsecured loan

- Loan received from shareholder

- Pension fund liability

- Loan received from director

- Bonds payable

- Notes payable

Short term liability:

This section includes liability due within 1 year or less. This covers short term debts and provisions for expense. Following liability can be included here.

- Creditors ( Bills payable)

- Advance received

- Bonds payable

- Notes payable

- Short term loan received

- Tax payable

- Interest payable

- Rent payable

- Provision for taxes

- Other provisions

Income statement ( Profit & Loss Statement):

Income statement is the second most important accounting report. It is also called Profit & Loss statement ( Report).

Profit and loss statement shows net income and gross income during the specific period. Income statement can be prepared on the monthly, quarterly or annual basis. It is advisable to get prepared and review your income statement on monthly basis.

There are certain benefits of income statement:

- It shows profitability.

- Helps to identify major cost elements in business.

- It helps to track and reduce unnecessary expenses in the business.

- It helps in preparation of GST / Vat returns.

- It helps in filling of taxes.

What includes in income statement ?

Income statement structure comprises in two parts – Income and Expense.

Income to show:

- Sales ( local and online)

- Purchase ( For retailer)

- Cost of goods sold ( For manufacturer)

- Labor cost

- Employee wages and benefits

- Insurance

- Transport

- Travel

- Meals & Entertainment

- Fuel

- Power

- Subscriptions

- Marketing expense

- Accounting fees

- Penalty

- License charges

- Interest

- Rent

- Lease

How to prepare income statement for taxes?

We always advice hire professional accountant or bookkeeper to prepare reports for taxes. However, If you are small business, you can prepare your income statement by using below formula:

Profit before tax =

Sales / Receipt during the year ( Money received in bank account)

Less

Expense done during the year ( Get reference from bank statement and credit card)

This method is ideal for very small business having few transactions during the year. Don’t include personal expense while calculating net profit of business. Now, lets understand this with sample income statement.

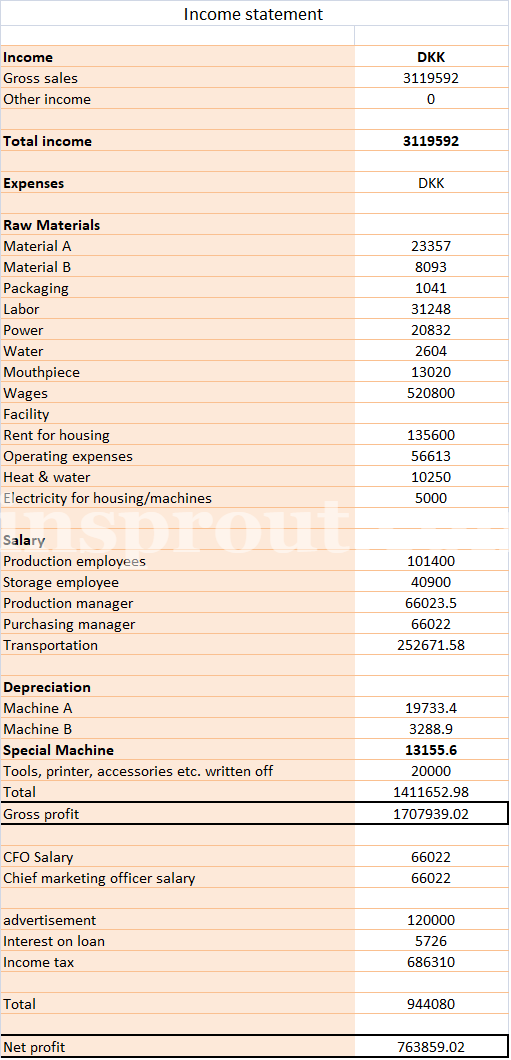

Sample income statement :

Understanding income statement is really easy. Below is the example of income statement for manufacturing company. If you are service business, no cost of goods sold or production cost will be at expense section.

Cash flow statement:

Cash flow statement is the report which shows cash movement in business. It is not necessary to submit this report to accountant for taxes. Cash flow statement comprises three major elements:

Cash flow from operating activity:

This section covers cash movement due to operational activity. It covers activities of cash generated due to sales and expenses of the business. It also considers changes in cash due to increase/decrease of current assets and liability.

Please note that all non-cash items such as depreciation and provisions should not be included as cash movement. That’s why we minus or plus such items in cash flow statement.

Cash flow from investing activity:

This section covers cash movement due to sale and purchase of assets and investments.

Interest or dividend received is also part of cash flow from investing activity.

Cash flow from the financial activity:

This section shows cash generated due to financing from inside or outside of business.

It includes following items:

- Equity issued or repaid

- Debentures issued or repaid

- The loan is given or received

- Interest or dividend paid

Consider below example for a more clear view of cash flow statement.

Example of Cash flow statement:

| Cash Flow Statement | |

|---|---|

| Opening Balance | |

| Cash | 32000 |

| Bank | 101000 |

| Total | 133000 |

| Operating activity | |

| Net Profit and loss of the month | 312000 |

| Add Depreciation | 12000 |

| Add Loss from sale of vehicle | 45000 |

| Add Increase in Current Liablity | 32000 |

| Less Decrease in Current Liability | 2000 |

| Add Decrease in Current Asset | 13000 |

| Less Increase in Current Asset | 32000 |

| Net cash flow from Operating Activity | 380000 |

| Investing activity | |

| Purchase of Furniture | 33500 |

| Sale of vehicle | 106000 |

| Net cash flow from Investing Activity | 72500 |

| Financial Activity | |

| Loan received from Bank | 225000 |

| Loan repayment | 64000 |

| Net Cash Flow from Financial Activity | 161000 |

| Net Cash Flow During the month | 613500 |

| Closing Balance of Cash | 746500 |

Please note that all accounting software does not prepare cash flow statement automatically. Generally, your bookkeeper or accountant prepares cash flow statement manually.

What is difference between income statement and balance sheet ?

There are 4 key difference between income statement vs balance sheet :

- Period : Income statement is prepared for specific period ( For 12 months, 6 months, 3 months). Balance sheet is prepared on any specific date. Year end date, quarter end date etc.

- Usage : Income statement shows the profitability of the company. On the other side, Balance sheet shows position of assets and liability on specific date.

- Order : First, you need to prepare income statement and then and only then you can prepare balance sheet as profit / loss of the period is added to equity.

- Tax Requirement: Income statement is required at tax time by CPA to file your taxes. ( For USA). However, it is advisable that you ask both financial statements from your bookkeeper.

Other helpful reports:

Business has also other helpful reports:

Budget report:

Budgeting is the must for any business. As a business owner, it is easy to spend time in activity such as marketing and operational work and forget about the budget.

Even I have done the mistake of not making a budget and got surprised at year end by seeing unnecessary expenses I had done in business.

No matter, you are startups, growing business or large company, prepare or get prepared budget on monthly basis and compare it with your actual numbers.

Due to awesome software such as Xero and QuickBooks, now you can prepare a budget in less than half an hour. Read my post here about how to make budget in Xero.

Cash movement report:

It is the report showing cash inflow and outflow in business. It is unlike cash flow statement.

It just shows following :

- Opening balance of cash at month

- Cash inflow

- Cash outflow

- Closing balance of cash at month

Owner’s equity report:

Owner’s equity report covers liability of business toward proprietor or shareholder. We can also call this as inside liability.

It covers the following element for proprietary business:

- Opening balance of capital of proprietary

- Drawing or addition of capital

- Profit/loss during the year

For Corporate, it contains the following element:

- Share capital

- Reserves

With the power of cloud accounting, you can get equity report automatically from your accounting software.

Business Ratios:

Ratios are not the report but helpful to you to analyze your business progress. Please note these ratios can be prepared from finalized accounting reports. Ask your accountant to prepare ratios with a monthly report to get the full benefit of reporting.

Following ratios are helpful:

- Current ratio

- Return on equity

- Debt to equity ratio

- Gross margin percentage

- Net margin ratio

- Financial leverage ratio

- Total leverage ratio

- Operating leverage ratio

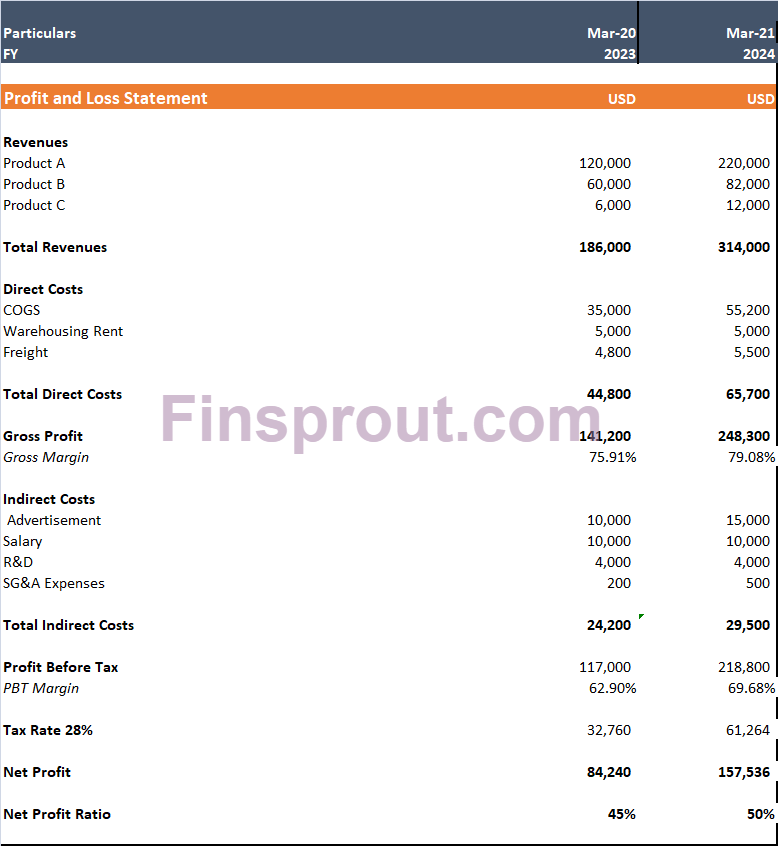

What is comparative income statement and balance sheet ?

You may heard about comparative income statement and balance sheet or comparative financial statement.

Comparative income statement is nothing but comparison of current year’s ( period) data with past year’s ( period) data. You may compare current year’s profitability result with past year. Or you may compare current quarter’s result with previous quarter. There is no requirement to prepare comparative statement separately.

You can just download it with your software by selecting option of comparison or if you have financial statements in excel, just add column for previous year and fill the data from previous year’s excel sheet.

Comparative income statement is helpful to get true view of business profitability and helpful to get motivation if there is profit increment.

You can also keep an eye on your expense by comparing past period’s expense with current period. Overspending can be caught and stopped at right time.

Sample example of Comparative Income Statement:

How to generate reports in various accounting system:

Generation of reports is now easy task due to the power of popular accounting software. With a blink of eyes, you can now get hundreds of report for your company data.

To avoid overwhelming, make sure to prepare a list of important accounting reports and get your bookkeeper or accountant printed for you.

If you are a small business and have not hired bookkeeper yet. No worries. We will see in this post how to generate important reports in various cloud accounting software.

How to generate reports in Xero:

First, I want you to congratulate to choose one of the best accounting software. With over 1 million subscribers, xero is becoming more and more popular due to its easy functionality.

To generate reports in Xero, take following steps:

- Login to Xero

- Click on top menu – Reports < Balance sheet or profit and loss

- You need to select balance sheet date. You can compare report with a variable period.

- You need to select reporting period for Profit and Loss report. For it, go to show date range and select appropriate reporting period.

- With Xero, you can export the report in various formats or print.

- You can publish or save the report in draft.

- Xero makes around 100 reports available to you. Go to all reports and you can get aged receivable, aged payable, customer invoice, supplier invoice report, inventory report, tax report available for you.

How to generate reports in Quickbooks:

Similar to xero, there is a simple process to generate reports in QuickBooks. Follow the step below:

- Click on report menu from the left side menu.

- Simply search the name of the report or select from the bottom list.

- Select appropriate period and compare period option.

- You can also customize report as per your need.

- Quickbooks outnumber Xero in reporting feature. There is a good number of reports available in QuickBooks.

- By giving “star”, the report will be added in favorite section.

- One missing feature is you cant export report in google drive with QuickBooks.

How to generate reports in Myob:

Similarly, you can download reports from Myob. Follow the step below to download the report:

- Go to reports from Top Menu

- Select required report.

- Select the period and report will be generated automatically.

- You can export the report in PDF and excel.

- Graphical presentation and customization can be done by using options at the right side.

Wrap up:

As a small business owner, it is difficult to manage time between lots of activities of the business. However, avoiding financial reports can become your big mistake.

Get the accounting reports prepared periodically by your accountant and review the reports spending 1-2 hours to get insight about the financial performance of the business. This 1-2 hour will save your thousands dollar per year and also help you to the move the ship of your business in the right direction. Found this article helpful? Spend 1 minute to share this on social media to say thanks.

- 1share

- 1Facebook

- 0LinkedIn

- 0Pinterest