- 0shares

- 0Facebook

- 0LinkedIn

- 0Pinterest

Year-round tax planning is one of the most powerful but underused financial tools available to U.S. taxpayers. High-income individuals, business owners, gig workers, investors, and even W-2 employees can legally cut taxes by planning throughout the year—not just when filing taxes.

Most taxpayers think about taxes after the year has ended. But once December 31 passes, almost every major tax-reducing opportunity has expired. At that point, filing your tax return becomes an exercise in reporting history—not shaping it.

True tax planning is about controlling the timing, character, and type of income and expenses in a way that minimizes your lifetime tax liability. You cannot eliminate taxes, but with year-round strategies, you can avoid unnecessary taxes, smooth cash flow, and keep more of what you earn.

What Is Year-Round Tax Planning?

Year-round tax planning means organizing your finances proactively by applying tax rules throughout the entire year—not just during tax filing season. The point is to make decisions that:

- reduce current taxes

- reduce future taxes

- increase tax-advantaged savings

- create strategic timing of income and deductions

- optimize investments for after-tax returns

- keep you compliant and penalty-free

It includes regular reviews of:

- income fluctuations

- tax bracket projections

- investment activity

- business expenses

- retirement contributions

- tax-favored accounts (HSA, FSA, dependent care)

- estate and gift planning considerations

Year-round tax planning is particularly important for:

- high earners who risk jumping tax brackets

- taxpayers subject to AMT or Net Investment Income Tax

- small business owners and self-employed individuals

- investors with taxable brokerage accounts

- real estate investors

- individuals approaching retirement

- people with stock options or RSUs

Short-term tax tricks don’t work anymore. IRS rules evolve constantly, and major opportunities—like timing capital gains, maximizing Roth strategies, or structuring business compensation—require planning months in advance.

Most taxpayers only think about taxes after receiving their W-2s, 1099s, and K-1s. But by then:

- income already happened

- deductions already occurred

- credits might have expired

- investment decisions are locked in

- employer election windows are closed

Year-round tax planning avoids this by giving you control. Instead of the IRS determining what you owe, you shape your financial year in a tax-efficient way.

Real Example:

A taxpayer earns $290,000 salary + $40,000 bonus in December.

He didn’t plan—so the bonus pushes him into a higher bracket, triggers NIIT, and reduces the value of certain deductions.

With year-round tax planning, he could have:

- deferred the bonus to January

- accelerated charitable contributions

- increased 401(k) contributions

- harvested capital losses to offset gains

- made a backdoor Roth IRA at a more favorable income window

Tax savings: $4,000–$11,000 depending on specifics.

STEP 1: Understand Your Tax Baseline

Every tax planning strategy starts with knowing your current situation. Your tax baseline is the foundation from which every decision is made.

Your tax baseline includes:

- Expected W-2 and 1099 income

- Business income or losses

- Filing status

- Dependents

- Retirement contributions

- Investment income (dividends, capital gains, interest)

- Real estate activity (rental income, depreciation)

- Available deductions

- Eligibility for credits

Review last year’s tax return and create a projection for the current year.

This helps you identify:

- your marginal tax rate

- whether extra income pushes you into a higher bracket

- the risk of AMT

- your capital gains exposure

- whether your itemized deductions exceed standard deduction

- if you’ll owe tax penalties

Tax planning begins with visibility.

STEP 2: Use Your Tax Bracket Strategically

Your tax bracket isn’t just a number—it’s a planning opportunity.

Key tax planning concepts:

1. Marginal vs. effective tax rate

- Marginal rate = tax on your next dollar

- Effective rate = total tax / total income

Tax planning focuses on your marginal rate.

2. Bracket management

If you are close to topping a bracket, you can:

- accelerate deductions

- defer income

- make extra retirement contributions

- increase HSA or FSA deductions

- spread income across years

3. High-income bracket strategy

Taxpayers earning above:

- $200,000 (single)

- $250,000 (married)

may trigger:

- Additional Medicare tax (0.9%)

- Net Investment Income Tax (3.8%)

- Phase-outs of deductions and credits

Year-round tax planning helps you stay below these thresholds intentionally.

STEP 3: Make Retirement Accounts the Center of Tax Planning

Retirement accounts are one of the strongest tax planning tools because they allow you to control:

- the timing of deductions

- the timing of taxable distributions

- whether income is taxed now or later

- whether growth is tax-free

Key strategic accounts:

- Traditional 401(k) – reduce current taxable income

- Roth 401(k) – tax today, but tax-free growth forever

- Traditional IRA – possible deduction

- Roth IRA – tax-free growth

- SEP-IRA (self-employed)

- Solo 401(k)

- Defined Benefit Plan (high contribution limits for older high-earners)

Advanced Planning Strategies

Backdoor Roth IRA

For high earners who exceed Roth limits.

Mega Backdoor Roth

For high-income employees with flexible 401(k) plans.

Roth conversions

Plan conversions in low-income years to reduce lifetime taxes.

Case Study Example:

A consultant earns wildly fluctuating income ($80k–$200k).

In her low-income year, she performs a $40,000 Roth conversion.

In her high-income year, she maximizes her Solo 401(k) to offset higher brackets.

Lifetime tax savings: $25,000–$60,000.

STEP 4: Leverage HSAs and Other Tax-Favored Accounts

HSAs are one of the rare tools that offer a triple tax advantage:

- Contributions: tax-deductible

- Growth: tax-free

- Withdrawals: tax-free for medical expenses

This makes HSAs central to advanced tax planning.

Additional tax-favored accounts:

- Health FSA

- Dependent care FSA

- 529 education plans

Pro Strategy:

Use your HSA as an investment vehicle, not a spending account.

Pay medical costs out of pocket.

Let the HSA grow tax-free for decades.

STEP 5: Create Deductions and Credits—Don’t Just Track Them

Most taxpayers react to deductions; smart taxpayers create them.

Key tax planning moves:

1. Charitable deduction bunching

Give 2–3 years’ donations in one year to exceed the standard deduction.

2. Donor-Advised Funds

Pre-fund future giving and take a large deduction now.

3. Qualified Charitable Distributions (QCDs)

For retirees 70½+, distributions from an IRA go directly to charity tax-free.

4. Education credits timing

Choose the calendar year for deductible tuition payments.

5. Energy credits

Plan solar, heat pumps, or efficiency upgrades in years when your tax bracket is highest.

Year-round tax planning means you decide the timing—not the IRS.

STEP 6: Tax-Efficient Investing & Tax-Loss Harvesting

Investment taxation is a huge area of lost money if not planned well.

Essential investment tax planning:

1. Prefer long-term gains

Hold assets > 12 months for lower rates.

2. Place assets strategically

- Use taxable accounts for index funds and tax-efficient holdings.

- Use retirement accounts for high-turnover or high-dividend assets.

3. Tax-loss harvesting

Sell investments at a loss to offset gains.

Reinvest in similar assets (while avoiding wash sale rules).

4. Manage dividends

High-dividend stocks may increase taxes unnecessarily.

5. Capital gains management

Avoid realizing gains in high-income years.

Example:

You offset $25,000 in long-term gains using tax-loss harvesting.

Savings: $3,750–$5,950 depending on bracket.

STEP 7: Smooth Income and Manage Estimated Taxes

Self-employed and gig workers must use tax planning to avoid penalties.

Strategies:

- Adjust estimated payments as income changes

- Use safe-harbor rules to avoid penalties

- Time business expenses strategically

- Delay or accelerate large invoices

- Purchase equipment when tax brackets are highest

- Use Section 179 or bonus depreciation where beneficial

STEP 8: Business Tax Planning for Owners

If you own a business, your tax planning opportunities multiply.

Key areas:

1. Choosing the right entity

LLC, S-Corp, C-Corp?

Each has different:

- tax rates

- deduction rules

- payroll requirements

- qualified business income (QBI) impacts

2. Owner compensation tax strategy

Salary vs. distributions for S-Corp owners can change tax outcomes by thousands.

3. Deductible business expenses

Year-round tracking matters.

4. Depreciation strategy

Bonus depreciation and Section 179 can dramatically reduce income.

5. Retirement plan selection

Solo 401(k), SEP IRA, or cash-balance plan can dramatically shift taxes.

Case Study:

An S-Corp owner earning $220k adjusts salary from $120k to $80k (still reasonable).

Result:

- $6,120 saved in payroll taxes

- Increased qualified business income deduction

- Increased ability to maximize Solo 401(k)

Total tax planning savings: $14,000–$20,000

STEP 9: Maintain Perfect Records

Good records are the backbone of successful tax planning.

Follow these principles:

- Track deductions monthly

- Keep digital receipts

- Use apps for business mileage

- Separate personal and business expenses

- Maintain investment activity reports

- Keep medical and charitable documentation

Poor records = lost deductions.

STEP 10: Monitor Law Changes and Deadlines

Tax laws change constantly and often without warning.

Stay aware of:

- annual contribution limits

- phase-outs

- expiration of certain credits

- new deductions introduced by Congress

- upcoming sunsets (2026 tax bracket increases)

Missing a deadline can erase thousands in planning benefits.

STEP 11: Use Professionals as Year-Round Partners

Don’t treat your CPA as a filing machine.

Use them as a strategic advisor throughout the year.

Contact your tax advisor when:

- you change jobs

- you get married or divorced

- you sell stocks or real estate

- you exercise stock options

- you start or close a business

- you experience income swings

- you receive an inheritance

- laws change

Tax planning works best before money moves—not after.

Get year end tax planning done by our team of CPAs. Book meeting here.

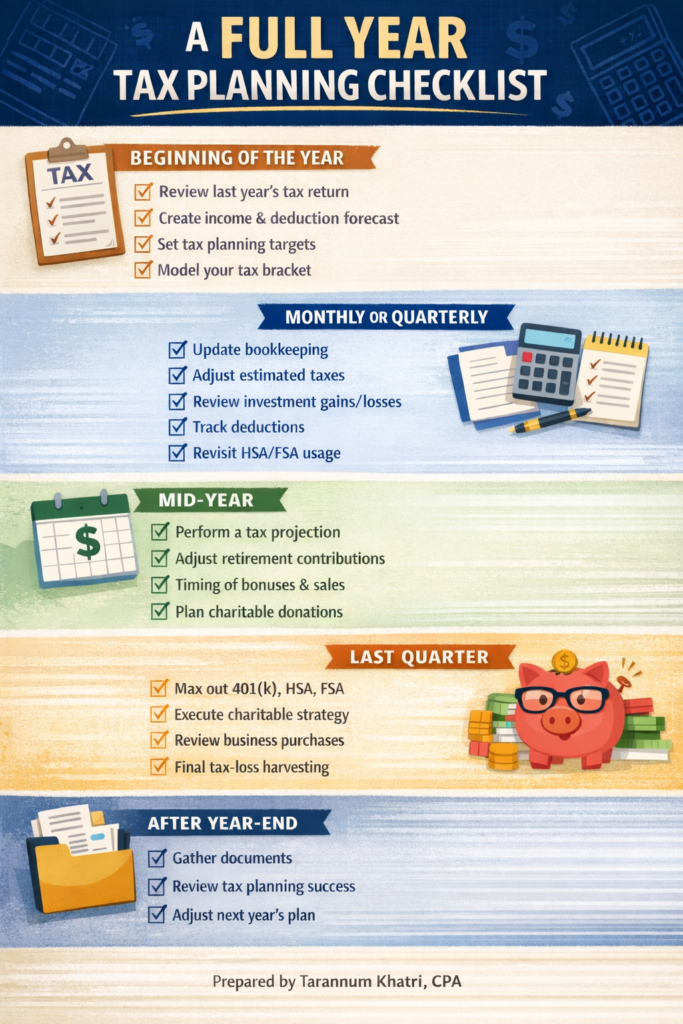

A Full Year Tax Planning Checklist

Final Thoughts: Tax Planning Is a 12-Month Financial Skill

Year-round tax planning is not just for wealthy taxpayers—everyone with income can benefit. The earlier you begin planning each year, the more control you have over your tax outcome.

With proactive strategies—like bracket management, retirement optimization, investment tax planning, business deductions, and smart timing of income—you can legally and significantly reduce your tax bill.

- 0shares

- 0Facebook

- 0LinkedIn

- 0Pinterest